Real estate investors in the United States are embracing a strong growth mindset in 2025, with a majority planning to expand their portfolios and invest significant amounts of money improving their current properties, reported RentRedi, a provider of property management software to ease the renting process for landlords and renters. The RentRedi survey, which analyzes responses by region and landlord size, highlights notable trends in investment strategies, renovation spending and business priorities.

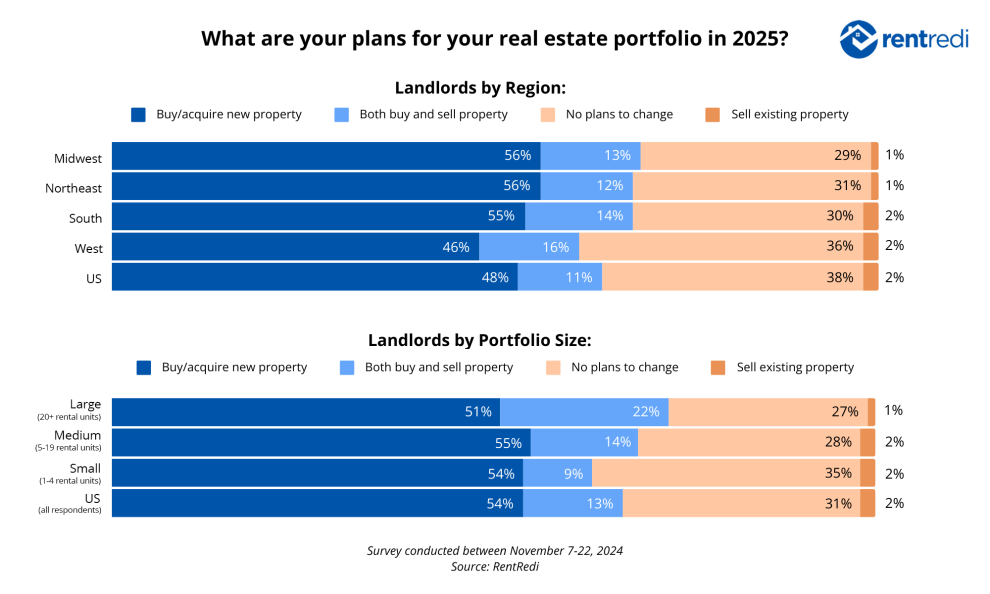

According to the survey, conducted from November 7 to 22, 2024, 59% of RentRedi landlords in the U.S. plan to buy property during 2025. Landlords in the Midwest and South are the most likely to acquire new properties at 69% each, with Northeast landlords slightly behind at 68%, Landlords in the Western U.S. are the only group that lags behind the national average, with 52% of landlords planning to purchase property. Breaking the numbers down by landlord size showed that 73% of large landlords (20plus rental units) are likely to acquire new property in 2025, followed by medium landlords (five to 19 rental units) at 69% and small landlords (one to four rental units) at 63%.

Regardless of location or portfolio size, landlords are focused mostly on income generation in 2025, with no group deviating significantly from the 47% national average. A significant amount of landlords also lists long-term investment (33%) and financial freedom (19%) are their primary goals in managing rental properties in 2025. Short-term value increases appear to be the least priority (1%), reinforcing the perspective that real estate remains a long-term wealth-building strategy for most Americans.

The majority of landlords (43%) are prioritizing revenue growth this year, and 31% of landlords view time commitment as the main barriers to reaching their goals. Other operational hurdles including increased maintenance costs, property taxes, and insurance costs, as well as more stringent laws and regulations, remain steady among landlords across all regions and portfolio sizes.