Depending on the number of their holdings, residential landlords use very different bookkeeping methods, revealed the Landlords Tax Preparation Trends Survey from property management software provider RentRedi. The data highlights key differences in tax filing methods, expenses and the reliance on professional services among small, medium, and large landlords.

At 29%, small landlords (1-4 rental units) are the most likely to use an accountant or CPA to prepare their taxes as compared to the roughly 23% of medium landlords (5-19 rental units) and large landlords (20-plus rental units) who hire tax professionals. Large landlords (17%) are the least likely to rely on manual methods such as pen-and-paper or spreadsheets, whereas 1 in 5 small and medium landlords are the most likely to do so.

“The data highlights a significant opportunity for property management software to bridge the gap in tax preparation,” said RentRedi Co-founder and CEO Ryan Barone. “Our software can help independent landlords reduce the time and effort spent on tax preparation by moving away from pen and paper or spreadsheets to digital solutions that improve accuracy and organization.”

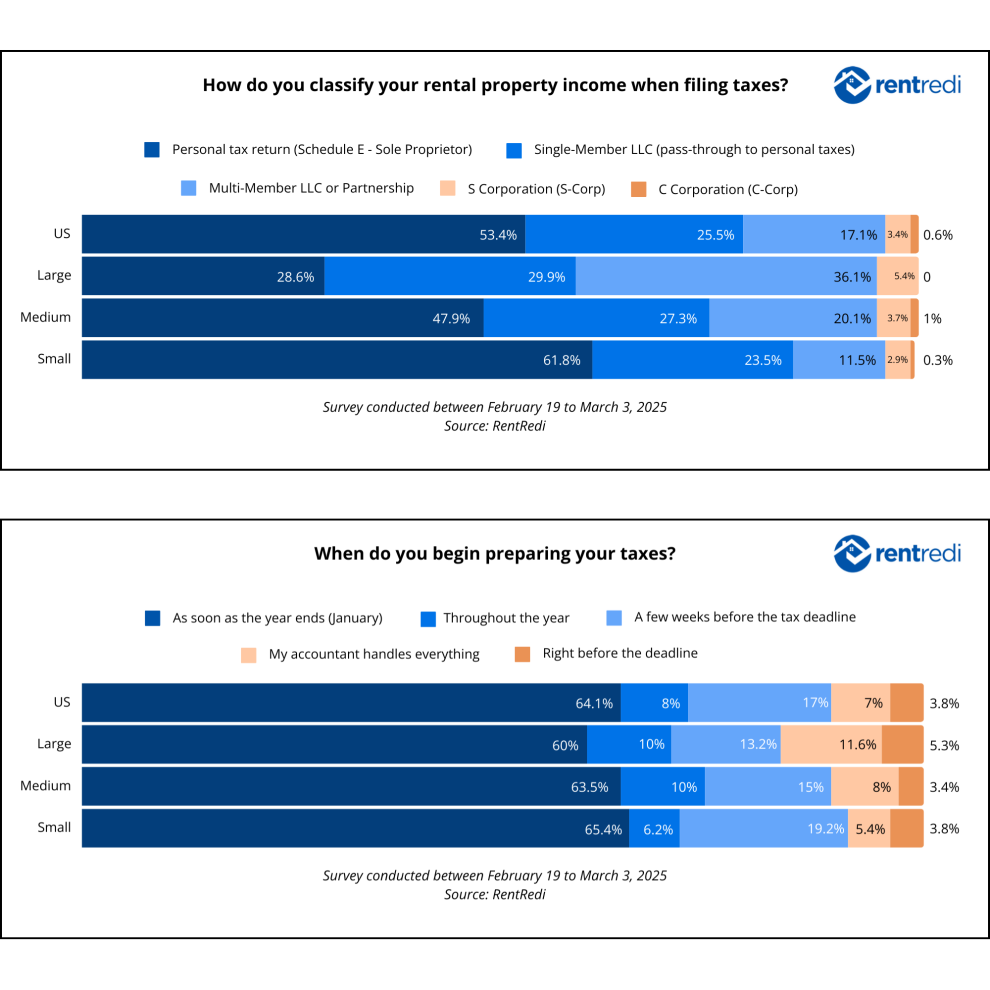

The survey further found that filing methods also vary widely across landlord sizes. A sizable 62% of small landlords file their rental property taxes along with their personal tax returns. Large landlords take the opposite approach, with only 29% filing under personal tax returns, while 66% opt to file under LLCs. Medium-sized landlords, on the other hand, are almost evenly split between filing under personal tax returns (48%) and filing under an LLC (47%).

When it comes to accounting costs, large landlords tend to invest the most, with 42% spending at least $1,000 on tax services. By contrast, only slightly more than 1 in 10 small landlords reported spending that much, with more than half keeping their tax expenses under $500.

Nearly two-thirds of landlords begin their tax preparation as soon as the new year begins, and requesting a tax extension is not uncommon among landlords. Nearly one-quarter of large landlords request an extension, compared to 11% of small landlords who also seek extra time to file their taxes.

RentRedi landlords were surveyed between February 19 and March 3, 2025. There were 1,891 respondents in total.